If you have ever been involved with the development of income property then you may have heard this dictum: One can describe virtually any development project as…

- a use looking for a site or

- a site looking for a use.

Out of this ying and yang school of development arose two classic techniques to assess feasibility: The Back Door and the Front Door approaches.

Let’s first take a look at the Back Door Approach

You might employ the Back Door approach if you have a use looking for a site. You know what you want to build and can reasonably estimate the kind of rental revenue it can generate. The question for you as the developer is, “Will that revenue be sufficient to justify the cost of development?”

You might employ the Back Door approach if you have a use looking for a site. You know what you want to build and can reasonably estimate the kind of rental revenue it can generate. The question for you as the developer is, “Will that revenue be sufficient to justify the cost of development?”

Presumably, this technique is called “back door” because you’ll back into the maximum project cost that the use will support. Then, like Hamlet examining Yorick’s skull, you’ll ponder it until you decide if you can actually do the deal. In short, if your intended use will support a project that costs $x and no more, you must decide if you can you develop it for those $x.

To do the math, start by determining the extent of rentable square footage that you can build on this parcel. Obviously you need to take into consideration issues such as lot coverage, height restrictions, floor area ratios, parking requirements and so on to determine what is permissible as well as possible. Depending on the complexity of the use, you might then simply multiply the total rentable square feet by the average rental rate or you may need to create a proposed rent roll on a space-by-space basis. In any event, your first step here is to establish an estimate of the project’s Gross Scheduled Income.

From this point, you work through the numbers exactly as you might in our Real Estate Investment Analysis software or as shown in our courseware. From the Gross Scheduled Income you subtract a Vacancy and Credit Allowance. That gives you the Gross Operating Income (or Effective Gross Income, as some prefer to call it). Next you subtract all operating expenses, which leaves you with the property’s expected Net Operating Income.

From here you want to establish the maximum loan amount that the NOI can support. If you want to take the quick route you can download the free real estate calculator program we provide at realdata.com and use the section called, of all things, “Maximum Loan Supported by Property Income.” If you’re a rugged individualist, you can also do the math yourself: Divide the NOI by the lender’s required Debt Coverage Ratio; then divide again by the annualized mortgage constant (which is 12 times the monthly payment amount for a $1 loan at the interest rate and term that the lender will provide).

Now you know the maximum loan that this project can support. The Loan-to-Value ratio should define the relationship of this loan amount to the maximum value of the whole package. So, divide by the lender’s maximum Loan-to-Value percentage and you’ll have the Maximum Total Project Cost. Put it all together and it looks like this:

Total Rentable Square Feet x Average Rental Rate

= Gross Scheduled Income

Vacancy and Credit Allowance

= Gross Operating Income

Operating Expenses

= Net Operating Income

= Maximum Total Project Cost

To put this more succinctly, you started with the gross rent, pared that down to a NOI, found the maximum loan the NOI could support and then applied a Loan-to-Value ratio to reach the Maximum Total Project Cost.

The next step in assessing the feasibility requires you to pick apart that total project cost. The total is made up of three parts: Hard costs, soft costs and land. You know what you’re planning to build, so you can figure the first two:

the hard costs, which include primarily construction but also items such as civil/mechanical utilities and environmental remediation;

the soft costs, such as architectural and engineering, loan fees and interest, appraisal, legal fees, permits and zoning-relating costs.

The hard costs and soft costs combine to represent everything in this project except the value of the land. So, if you subtract those hard and soft costs from the Maximum Total Project Cost, what’s left is this: the maximum value of the land for you to be able to consider this project feasible.

Keep in mind that if you already own the land, it’s the land’s current market value not its purchase price that you want to consider. If the land is worth more or costs more to buy than this maximum value you just calculated, then according to the Back Door approach the deal is not feasible.

Maximum Total Project Cost

Project Hard Costs

Project Soft Costs

= Maximum Site Cost or Value

Example:

You propose to build an income property with 20,250 rentable square feet. The average rental rate will be $20 per square foot. You provide a 10% allowance for vacancy and credit loss and expect operating expenses to total $44,000 per year.

Your lender will provide financing at 8% for 240 months and requires Debt Coverage Ratio no less than 1.2 and a Loan-to-Value Ratio no greater than 80%. What is the Maximum Total Project Cost?

You estimate Hard Costs to be $2,430,000 and Soft Costs to be $625,000

You own the land, which has a current market value of $750,000. Does it seem feasible to build the project on this site?

Start with the Gross Income and work your way through the model above:

20,250 Total Rentable Square Feet x 20.00 Average Rental Rate

= 405,000 Gross Scheduled Income

10% Vacancy and Credit Allowance

= 364,500 Gross Operating Income

44,000 Operating Expenses

= 320,500 Net Operating Income

= 3,326,142 Maximum Total Project Cost

If your lender requires that you have enough Net Operating Income to cover 1.2 times the debt service (i.e. 1.2 Debt Coverage Ratio) then your NOI of 320,500 can justify annual debt payments up to $267,083.

Given your lender’s financing terms (expressed in the Mortgage Constant), the mortgage can support a mortgage of $2,660,913.

If the Loan-to-Value ratio is 80%, that $2.6 million represents 80% of the project’s value; so 100% of its value equals $3,326,142.

What will it cost you to build, not counting the land? Your combined Hard Costs and Soft Costs total $3,055,000. If the Maximum Total Project Cost that the income stream can support – in other words, if the most you should spend on the complete package, given the potential rental income – is $3,326,142 and the cost of physical construction is $3,055,000, then the difference of $271,142 is the most that you can justify spending on the land. But the land is really worth $750,000. So it appears that it won’t make sense for you to build this project on this site. The cost of physical construction plus the value of the land are greater than the rent can support.

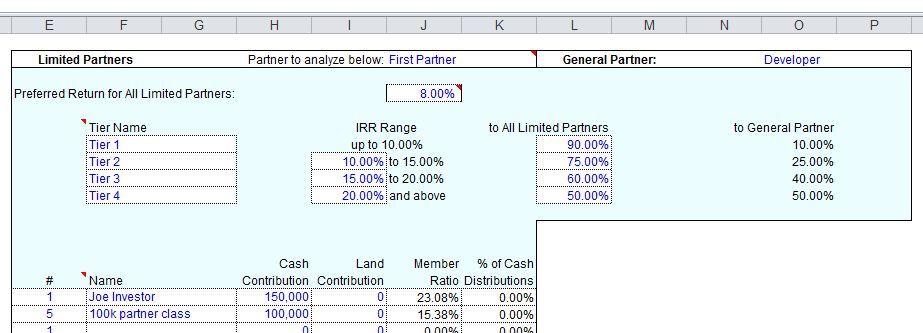

For those of you familiar with RealData’s Commercial / Industrial Development software, that program uses some of the back-door rationale while adding a few twists of its own. You can indeed let the program back you into the maximum development loan, but our experience is that developers are interested in projects that are profitable, not just feasible, so you can work with other considerations in that program to guide your project model.

In our next article, you’ll see what it’s like to come in the Front Door.

—-Frank Gallinelli

Want to learn more about real estate investing? Visit learn.realdata.com

####

Your time and your investment capital are too valuable to risk on a do-it-yourself investment spreadsheet. For more than 30 years, RealData has provided the best and most reliable real estate investment software to help you make intelligent investment decisions and to create presentations you can confidently show to lenders, clients, and equity partners. Find out more at www.realdata.com.

Copyright 2016, Frank Gallinelli and RealData® Inc. All Rights Reserved

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

We’ve just released an updated version of our video tutorial,

We’ve just released an updated version of our video tutorial,

Globally adjust view +10% +25% etc. – Perhaps your desktop has one screen resolution and your laptop something totally different. And maybe neither of them looks good in the default view when you open the program. In the past you had to change the “zoom” setting for each worksheet individually, but we’ve added a function that allows you to apply a global view setting across all the sheets. So whether you want big type or small, the solution is a click away.

Globally adjust view +10% +25% etc. – Perhaps your desktop has one screen resolution and your laptop something totally different. And maybe neither of them looks good in the default view when you open the program. In the past you had to change the “zoom” setting for each worksheet individually, but we’ve added a function that allows you to apply a global view setting across all the sheets. So whether you want big type or small, the solution is a click away.

In an earlier article we discussed the

In an earlier article we discussed the