In the first part of our discussion, you looked at the simple math that underlies Cash-on-Cash Return. The short version goes like this: First you calculate your property’s first-year cash flow before taxes—essentially all the cash that comes in from operating the property minus all the cash that goes out. Then you divide that by your initial cash investment, and that percentage is your Cash-on-Cash Return. Nothing could be simpler.

Simplicity is a good part of CoC’s appeal. Unfortunately, that is also part of its weakness. If you are using this metric to help you decide whether a potential income-property purchase is a promising investment or not, then you need to look carefully at the story—or stories—that may lurk behind these numbers. In keeping with our literary metaphor, let’s call them our subplots.

Subplot #1: A Point in Time

Clearly, when you take the first-year’s cash flow and divide it by the cash used to purchase, you are looking at a property’s performance essentially at a point in time, a single year. To be sure, the reliability of your cash flow projection is likely to be greatest in that one, immediate time frame. I often hear investors say that they are not comfortable trying to predict the future, that they would rather just look at what is happening now; and they are quite justified in saying that if the return looks grim or perhaps negative right out of the box, then they have no interest in looking further.

Understandable, but potentially shortsighted—literally. By looking at a single year, you are looking at what may be an improbable investment horizon. Will you keep this property for just one year? If not, if you plan to hold on to it longer, then you’re not taking into account anything having to do with its possible future performance. Do you believe each future year will be exactly like this year, or could reasonably anticipated changes in cash flow (such as schedule increases in commercial lease rents, or large expenditures for needed repairs) push the needle far to one end or the other?

Subplot #2: The Time Value of Money

“All right,” you say, “then I’ll estimate the Cash-on-Cash Return for each of the next several years.” That may look like a step in the right direction, and I talk to a lot of folks who insist on doing just that, but it won’t take into account the time value of money. You’ll be looking at the face value (undiscounted) of expected future cash flows, and weighing them against the present value of your cash investment today. Go back to that original example, where you invested $100,000. If you predict a $20,000 cash flow ten years from now, does that really mean your investment is returning 20%?

To be fair, future-year Cash-on-Cash can impart some useful information. For example, if the metric is both positive and increasing, then you can infer that your cash flow is improving each year. The trend can help inform your decision, but the actual percentage return may not have a great deal of meaning.

Subplot #3: Smoke and Mirrors

You retreat and say, “OK, let’s go back to thinking about just the first year of operation. Surely the Cash-on-Cash should give me a good sense of initial performance.” Do you remember the old computer chestnut, “Garbage in, garbage out?” Your results are only as good as the assumptions and data that you put in the dispose-all, and perhaps things aren’t always (or ever) what they seem.

Consider:

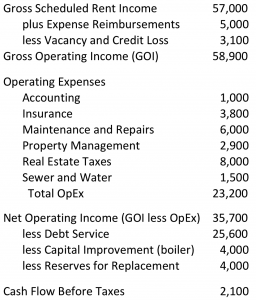

You are looking at in income-and-expense statement (what we call an APOD in real estate investing—Annual Property Operating Data) provided by the seller of the property. The cash flow is based, in part, on operating expenses, one of which is Maintenance and Repairs. The figure in the example above is $6,000; you secure the owner’s tax return and confirm that this is indeed the figure he declared.

That is how much he actually spent, but the figure seems a bit low to you. Does it mean the owner performed as little maintenance as he could get away with and never fixed anything until it was absolutely necessary? Perhaps the owner did this to prop up the property’s cash flow in anticipation of selling. Despite the fact that the expense disclosed is technically correct, you decide you shouldn’t use it as a forward-looking assumption. Instead, you will probably have to project spending more once you take ownership, resulting in a diminished cash flow and a lower Cash-on-Cash Return. In addition, the property may actually be worth less than you assumed, since it does not throw off as much net income as you were led to believe.

Now take a different point of view. Based on your experience, you think the maintenance and repair expenditure shown is surprisingly high. Could there be an explanation for that? Perhaps the owner used the past year to catch up on deferred maintenance so the property would look more presentable when he put it up for sale. You might be tempted (but only in your most private thoughts) to test the impact of lower maintenance costs on your cash flow and CoC return. Once again, the amount that was disclosed, although correct, may not be the amount that gives you the best estimate of future cash flow or Cash-on-Cash Return.

Subplot #4: The Forecast—Cloudy, with a Chance of Cash Flow

Finally, there is the larger issue of the structure of the cash flow statement itself. What you decide to include or exclude in your forecast of future cash flow will almost certainly be driven by your personal agenda in creating that cash flow statement. Are you the seller of the property, looking to make its income stream appear as strong as possible? Are you the buyer, trying to make a realistic projection of how this property will really perform, and perhaps also conveying that stark realism back to the seller as part of your price negotiation?

In either case—as well as in any of several others, such as buyer looking for financing, general partner looking for equity investors, etc.—you might be putting a bit of a spin on the data, the better to support your point of view and the message you want to deliver.

If you’re the seller, then a bit of topspin seems like a good idea to you. In the example shown in Part 1 of this discussion, you might argue that, not only did you provide accurate and verifiable income and expense data, but that you were being exceptionally open and above-board by suggesting an allowance for vacancy and credit loss even though you experienced no such loss. Group hug.

But if you’re the buyer, you might return this with some backspin. You thank the seller for being so forthright, but add that you believe the vacancy and credit loss allowance should be closer to 5%, not 3%. In addition, you point out that routine maintenance is great, but will not prevent big-ticket items from wearing out eventually. For example, the heating boiler is barely hanging on, and the flat roof has less than 10 years of life left in it. Hence you propose reconstructing the cash flow statement to reflect the higher vacancy allowance, as well as need for an immediate capital improvement and an ongoing set-aside of cash flow into a reserve account to deal with future replacements, such as the roof.

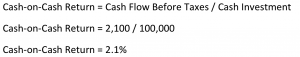

What previously was a robust 10.4% return now becomes an anemic 2.1%.

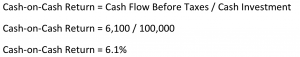

The seller objects that this isn’t entirely fair, since the boiler repair is a one-off event, and removing that cost would bring us up to 6.1%.

The seller’s argument cycles you right back to Subplot #1 about the hazards of relying on a rate-of-return metric that looks only at a point in time in what is probably going to be a long-term investment.

Is There a Bottom Line?

What should you conclude about Cash-on-Cash Return? Is it, as some contend, the only metric worth looking at? Is it of no use at all? The best answer probably lies somewhere in between, that you need to recognize both CoC’s strengths and its limitations, and not rely on it as your sole investment decision-making tool.

On the plus side:

- It is quick and easy to calculate.

- It can give an immediate comparison to the return on other short-term investments.

- It focuses on the most current performance of the property; the more recent the data, the more likely it is to be reliable.

Among the negatives:

- It focuses on single point in time; you may be intending to buy and hold for an extended period, and the future performance of the property can differ greatly from the short term.

- It does not take into account the time value of money; if you use it beyond the current period, you may be comparing a future, undiscounted cash flow to the amount invested today.

- It is easy to manipulate the results; hence, a novice investor who relies on this metric alone can be misled by what a third party chooses to include or exclude from a property’s cash flow statement.

So are there some bottom-line recommendations here? Of course.

Start off by trying to develop a CoC calculation in which you can have reasonable confidence.

To do so, remember that there is no substitute for due diligence. At the most basic level, you need to confirm whether the data you see on the cash flow statement for a particular property is reasonable and accurate. Then you need to go further and examine the physical property and the market to see if there are issues that may affect your confidence in those numbers. Is there any reason to doubt that the current revenue stream will continue as it is now? Is the demand for space in this market changing, for good or ill? Is there deferred maintenance that you will have to deal with? Based on what you find, you may have to reconstruct that cash flow statement.

Don’t just look at what is on the cash flow statement; look for what might be missing. A seller may not volunteer an allowance for vacancy or a need to fund a reserve account, but such items are going to be part of your reality as an owner.

So long as you approach it with sufficient care and due diligence, the Cash-on-Cash Return can give you a useful first look at how a property might perform; but before you commit your investment dollars, you need to do more.

If you plan to operate this property for several years, then you need to take the long view. You should identify your likely investment horizon, and then build a series of pro formas to forecast how the property might perform over time.

A series? Yes. Don’t try to nail your projections of future performance in one pass. Do a best-case, worst-case, and in-between forecast of future cash flows and ultimate resale of the property. Look at the ongoing Debt Coverage Ratio in each case. Examine the IRR or MIRR. Even compare this property to others you might be able to acquire.

Be thorough. Be wary of shortcuts. You’re buying a future income stream; do your homework and run your numbers so you can understand just what it is that you’re buying. Your investment success depends on it.

read my postscript

— Frank Gallinelli

####

Your time and your investment capital are too valuable to risk on a do-it-yourself investment spreadsheet. For more than 30 years, RealData has provided the best and most reliable real estate investment software to help you make intelligent investment decisions and to create presentations you can confidently show to lenders, clients, and equity partners. Learn more at www.realdata.com.

Copyright 2013, Frank Gallinelli and RealData® Inc. All Rights Reserved

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.