If you watch what’s happening with the stock market, you’re probably ready to reach for the Dramamine. It’s like being trapped in a really fast elevator, except the buttons don’t take you where you expect to go. Maybe somebody else is controlling the ride.

You realize that most of the people you see who have achieved genuine financial independence have done so with real estate. Your next step is to figure out how you can do the same.

But… real estate comes in a lot of flavors. There are some fundamental differences among the various types, and you need to understand those differences before you start your investing campaign. One size does not fit all. Let’s look at a few of your options.

REIT (Real Estate Investment Trust)

A REIT is fundamentally a stock investment, a lot like the ones you may have decided to put behind you.

If you buy stock in an oil company, you’re investing in a firm that probably owns and operates wells, refineries, and retail distribution.

If you buy stock in a REIT you’re investing in a company that owns and operates real estate, and probably deals with retail customers, aka tenants. Pretty much the same business model, different industry. The advantage here, as with other stocks, is liquidity. Buy today, sell tomorrow. But remember, it’s someone else’s company, and you’re a few layers away from actually investing in real estate.

Fix and Flip

This is a situation where you buy a property, fix it up, and sell it for a profit. The plan is for the ARV (After Repair Value) to be greater than the sum of the cost to buy plus the cost to repair. The single-family house is probably the most common fix-and-flip.

Sounds good, and plenty of people have made money doing this, but it’s far from the slam dunk you might see on reality TV. The first challenge is in finding a suitable property—one that you can buy on favorable terms, get financed, improve substantially at a reasonable cost, and sell quickly for a profit.

Where many flippers run off the rails is in underestimating their true costs. Besides the cost to buy and fix-up, you have to carry the property. This means loan payments, property taxes, insurance, and utilities during the fix-up period and also while you’re searching for a buyer. In addition, there may be costs of sale (commission and attorney), as well as taxes on the profit. In many circumstances, your profit might be taxed at ordinary income rates, not as capital gain.

All of these are considerations that a real estate developer might routinely take into account—and indeed, one could argue that a flip is essentially a type of development project—but the budding entrepreneur might not start out with so broad a perspective. And you might not have the infrastructure in place—e.g., access to capital and to contractors—that you need to achieve a suitable profit.

Single Family Houses as Rentals

Many first-time investors gravitate toward single-family houses as rental properties.

That choice may be driven more by personal comfort level than by the merits of this approach as an investment strategy. If you have been a residential tenant, then you probably know something about the roles and responsibilities of both tenant and landlord. Even if you don’t know the fine points of leasing and landlording, you understand the basic ground rules and this seems like familiar and comfortable territory.

These are benefits not to be taken lightly, but there are other considerations. Have you made a realistic projection of cash flow? Will your rent revenue be sufficient to cover all of your expenses, including financing? Do you recognize that losing one tenant equates to 100% vacancy? If that occurs, how long can you soldier on without revenue?

Perhaps the most important concept to recognize here is that there is a fundamental difference between a single-family home and a more typical income-property investment. The worth of any investment ought to be related to its ability to produce a return, but generally the value of a single-family home is based on the competitive market for similar properties – in short, comparable sales. So you might be missing out on something here.

Let’s look now at an option that offers what might be the biggest single benefit available to you when you choose real estate as an investment.

Income-Producing Property, Buy and Hold

In the spirit of full disclosure, my specialty is income-producing property, particularly what is often called “buy and hold.” It’s what I teach and write about, so now excuse me as I get on my soapbox.

This type of property generally includes non-residential (such as office, retail, mini-storage etc.) and apartment buildings with more than four units, though some investors will include four-unit properties as well.

These properties differ in a very important way from those whose main characteristic is to serve as a personal residence. As I mentioned above, the market value of a personal residence is almost always based on comparable sales. Buyers of single-family homes are essentially purchasing a lifestyle – a location and a physical property that offers a basket of amenities. The market value is based on those factors, so they drive what you’ll typically pay to acquire the home, and the price for which you’ll be able to sell.

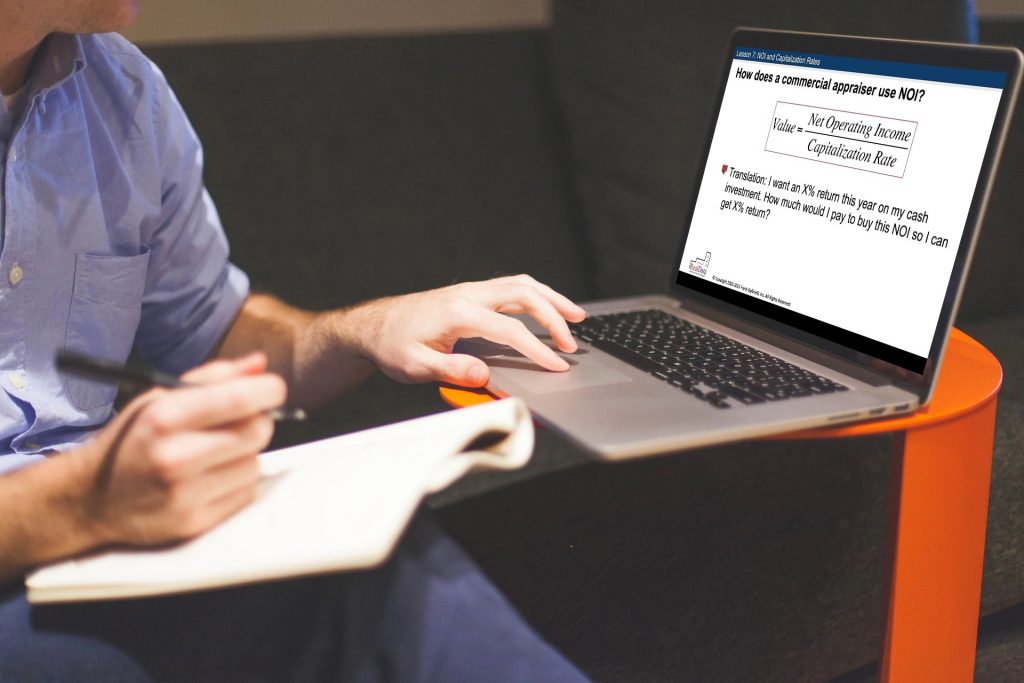

The value of a true income-property, however, is based on its ability to generate income. The location and attributes of the physical property are not irrelevant, but they matter only insofar as they affect that ability to generate income. You could have two seemingly identical properties side-by-side. One is managed well and produces a strong net income. One is managed poorly, and has a weak bottom line. Physically similar, but the former will command the higher price.

Why does this matter? Unlike with stocks or with personal-residence real estate, you, the investor, have the opportunity to create value, to create equity. How? By increasing the property’s net income.

My favorite personal war story in this regard is about a property that a friend and I bought many years ago. The units were rented significantly below market, and we purchased it at a small premium over what those rents justified. As leases expired we increased rents substantially, just about doubled the bottom line, then sold the property for twice what we paid.

The key point here is that we didn’t have to rely on the sale prices of comparable properties in the neighborhood to increase in order for the value of our property to rise. We were able to create value proactively by doing a better job of managing. We created equity.

This ability to have such a degree of personal control over the success of your investment is something you find in very few investment vehicles outside of income-producing real estate.

The Bottom Line

So what will be your choice, what works best for you?

- The REIT is certainly easy and liquid, but it is still a stock.

- The fix-and-flip holds out the possibility of a very big payday, but you need a dependable and capable team that can move quickly; and as with any high upside there is also the greater risk of loss.

- The single-family rental is an appealing way to break into real estate because of its familiarity, but it’s an investment mainly to the extent that you benefit from external market forces.

- And then there is my favorite, the buy-and-hold income property. It’s an option that gives you the opportunity to exercise significant personal control over the success of your investment without going into the deep end of the risk pool.

My bias toward the last option notwithstanding, there is no choice that’s right for everyone. Your best decision is an informed decision, and that’s what I hope I’ve helped you reach.

—Frank Gallinelli

Ready to learn more about real estate investing? Visit learn.realdata.com

####

Your time and your investment capital are too valuable to risk on a do-it-yourself investment spreadsheet. For more than 30 years, RealData has provided the best and most reliable real estate investment software to help you make intelligent investment decisions and to create presentations you can confidently show to lenders, clients, and equity partners. Find out more at www.realdata.com.

Copyright 2018, Frank Gallinelli and RealData® Inc. All Rights Reserved

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

Your personal certificate page includes a dashboard, as shown at the left. From there you can…

Your personal certificate page includes a dashboard, as shown at the left. From there you can… We’ve just released an updated version of our video tutorial,

We’ve just released an updated version of our video tutorial,  In an earlier article we discussed the

In an earlier article we discussed the