As the summer 2013 begins to cool off, many real estate markets are finally starting to heat up. For a lot of folks, who have slogged through five of the worst economic years in memory, it feels a bit like we’ve just been released from the locked trunk of a car.

The temptation now is to celebrate our release from investing confinement by jumping back into the market with both feet. Before we do so, however, it would be wise to reflect on a few of the lessons of recent history.

There were many reasons for the financial meltdown, but one of the biggest surely was the belief that real estate inexorably increases in value over time. To many people, that looked like a law of nature. The reality turned out to be different, and now, as property values start to rise, we have to resist the temptation to start believing this all over again. If not, we will simply create another bubble and repeat the cycle.

Another cause of that meltdown was the tendency to dismiss or completely ignore investment fundamentals. Real estate simply couldn’t fail to do well (after all, they’re not making any more of it), and we didn’t really need to think too hard about our investments because, surely, they would work out happily in the end.

Savvy investors always knew that this wasn’t necessarily true; they knew that income-producing real estate could go up, down, or sideways. Time, all by itself, does not create value; the ability of a property to produce income is what creates value, and so the prudent investor would take nothing for granted and always carefully weigh a property’s prospects for generating income today and in the future.

The beginnings of a general economic recovery—and, in particular, a real estate recovery— may signal that we can and should get back into the game, but it doesn’t mean that we can return to pre-2008 thinking and disregard the fundamentals that ought to guide our investment decisions: For example:

Due Diligence: This is just as important in good times as in bad. We need to examine thoroughly and critically all of the financial data we can get our hands on about a potential investment property. Are the rents really as represented? Are the operating expenses as portrayed by the seller reasonable and complete? Have we done a thorough assessment of the property’s physical condition?

It is essential to remember that a property doesn’t live in a vaccum, so our due diligence needs to extend beyond the individual property and include the local market as well. What is the prevailing capitalization rate for properties of this type in this market? What kind of rents are similar buildings actually getting, and what are the asking rents in properties that may be in competition with us for tenants? What is the current vacancy rate in this market, and has it been rising or falling? What is the general business climate, and in what direction is it headed?

Cash Flow: We always need to make hard-headed projections about the prospects for current and future cash flow. Too often we see investors, motivated to make a purchase and get on the presumed gravy train, put together the numbers they want to see. They ignore the potential for vacancy and credit loss. They ignore setting some of their potential cash flow aside each year as a reserve to pay for that new roof or new HVAC system a few years down the road. We should make best-case, worst-case, and in-between projections to give ourselves a sense of the range of possible outcomes.

It is important to be realistic about cash flow projections. Excessive leverage may seem like a great advantage on the day you close the purchase, but the high debt service may also result in very weak or even negative cash flow. Are you really prepared to support your property out of your own pocket, to absorb unexpected expenses or loss of revenue?

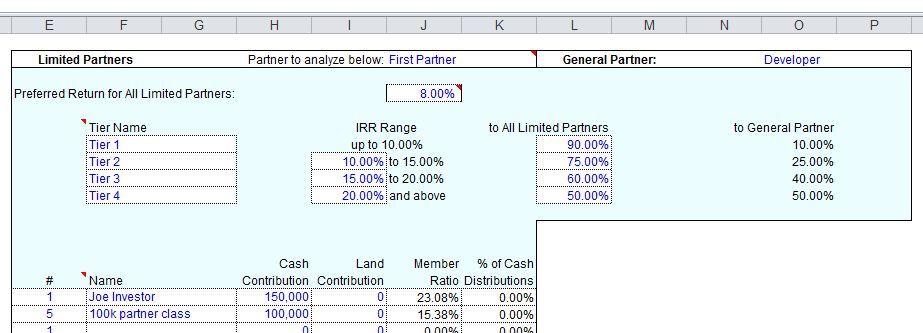

The Long View: We seldom buy an income property with the expectation of flipping it for short-term profit. Rather, our plan is probably to buy and hold so we can derive an annual cash flow plus a long-term gain when we sell. If that is indeed our plan, then we need to forecast the property’s performance not just for one year, but for a likely holding period—perhaps five, seven or ten years—and to compute an Internal Rate of Return for that holding period. Doing so can be especially valuable when we are looking at more than one property that we might purchase. Which one appears likely to give us the best overall return within our investment horizon?

The Last Word: Investing in real estate can be a profitable move in just about any economic climate if we proceed wisely, so to answer our initial question: Yes—if we’ve been on the sidelines, then this is a fine time to get back in. But as with any other kind of investment, we can just as easily lose money as make it if we charge ahead without doing our homework and without going through the kind of fundamental analysis and projection that is essential to smart investing. Success in real estate investing, as in most endeavors, doesn’t just happen by good luck or chance. We have to work at it and have our head in the game. The luck will follow.

— Frank Gallinelli

####

Your time and your investment capital are too valuable to risk on a do-it-yourself investment spreadsheet. For more than 30 years, RealData has provided the best and most reliable real estate investment software to help you make intelligent investment decisions and to create presentations you can confidently show to lenders, clients, and equity partners. Learn more at www.realdata.com.

Copyright 2013, Frank Gallinelli and RealData® Inc. All Rights Reserved

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.