One of the biggest things real estate investors should know about the new tax act, signed into law on July 4, 2025, is what it didn’t do. Instead of letting major parts of the 2017 Tax Cuts and Jobs Act (TCJA) expire at the end of this year, the new law keeps many of TCJA’s key provisions in place—some permanently, others with long-term extensions. And that’s good news for investors and developers, because several of the preserved measures directly impact how real estate investments are taxed and structured. But it also introduced some permanent changed and new incentives that are worthy of attention.

Just a side note: While the headline provisions of the new act are clear, the final IRS guidance and technical regulations haven’t been issued as of this writing, and there could be tweaks or clarifications once the full legislative text and administrative rules are published. We’ll walk you through what’s confirmed so far, but keep in mind that some further details may evolve over time.

Let’s take a look.

Bonus Depreciation:

Bonus Depreciation:

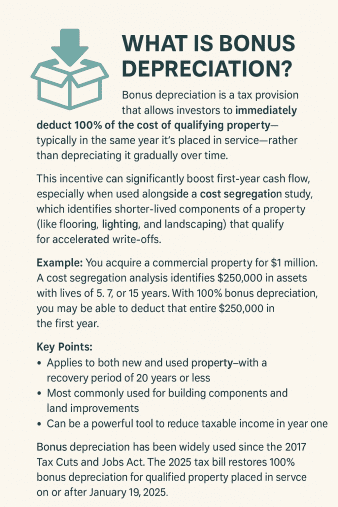

One of the most notable provisions of the new law is the restoration of bonus depreciation.

The 2025 law permanently restores 100% first‑year bonus depreciation for qualifying assets—such as furniture, fixtures, equipment, land improvements, and qualified improvement property (i.e., non-structural improvements).

The change applies to assets placed in service on or after January 19, 2025, reversing the scheduled phase-down that would have dropped it to 40% this year.

This is especially a win for investors using cost‑segregation studies to identify building components eligible for shorter depreciable lives—allowing them to take larger first-year depreciation deductions and reduce taxable income.

QBI (Qualified Business Income) Section 199A Deduction:

Originally introduced in the 2017 Tax Cuts and Jobs Act (TCJA), the QBI deduction lets many real estate investors who own property through pass-through entities—like LLCs, S-corps, partnerships, or even sole proprietorships—deduct 20% of their qualified business income. The 2025 law makes this deduction permanent, removing the original expiration date at the end of 2025. Lawmakers briefly considered bumping the deduction up to 23%, but in the end, they kept it at 20%.

This can be especially valuable if you own rental property as a pass-through entity and report your income on your personal tax return. But there’s a catch: the deduction begins to phase out if your taxable income goes over certain limits.

In 2025, the deduction starts to shrink once your income hits $197,300 if you’re single, or $394,600 if you’re filing jointly. If your income reaches $247,300 (single) or $494,600 (joint), your deduction will be fully eliminated.

Starting in 2026, these income thresholds will be adjusted annually for inflation. The new law also adds a cushion before the deduction is eliminated by increasing the income range over which the limits apply—by $75,000 for single filers and $150,000 for joint filers.

For example, if the single filer threshold is adjusted to $200,000 in 2026, the deduction wouldn’t be fully lost until income reaches $275,000.

And here’s a nice bonus: Even if your income is modest, the law now guarantees a minimum deduction of $400—as long as you have at least $1,000 of qualified business income. So if you’re running a small rental business or just getting started, you won’t walk away empty-handed. It’s a modest but meaningful way the law supports smaller investors.

Qualified Opportunity Zones:

Originally created under the 2017 tax act, the QOZ program was designed to spur investment in economically distressed areas by offering tax incentives for reinvesting capital gains through Qualified Opportunity Funds (QOFs). Under the new tax law, the program is now made permanent, and states will have the opportunity to re-designate zones every 10 years, starting in 2026.

One of the biggest updates is the move from a fixed capital gain recognition date to a more flexible, rolling five-year deferral. Under the new rules, if you reinvest capital gains into a Qualified Opportunity Fund (QOF) on or after January 1, 2027, you’ll defer the tax on that gain for five years from the date of your investment—rather than facing a hard deadline as in the original version of the law. The well-known 10-year holding period for excluding future appreciation is still in place, but investors now have more breathing room when it comes to timing. There are also added perks for rural zones, including a larger basis step-up and looser improvement requirements, which could make it easier to launch or expand real estate projects in those areas.

Section 1031 Tax-Deferred Exchange:

A like-kind exchange under Section 1031 allows real estate investors to defer capital gains taxes when they sell an investment property and reinvest the proceeds into another qualifying property.

The key word here, of course, is “defer” — not be confused with “permanently avoid.” As of this writing, it doesn’t appear that the new tax law has made any changes to the rules governing these exchanges, but because those rules are quite precise, it would be wise to keep an eye out for any new IRS guidance in this area.

Estate and Gift Taxes:

Estate taxes may not be a part of the day-to-day management of a property, but they can loom large in an investor’s long-term planning. Real estate can often be a high-value but illiquid asset, so that heirs could find themselves with a big tax bill but not the cash on hand to pay it — resulting in a rushed sale on unfavorable terms.

The new law raises the exemption to $15 million for an individual, or $30 million for a couple using portability. The exemption will be indexed for inflation, and it is permanent, i.e., it has no “sunset” date, as did the previous exemption. The new law did not repeal or amend the long-standing stepped-up basis rule. Under this rule, an heir receives property with a basis that equals the fair market value at the time of death. The heir can sell the property immediately with no capital gain (and no capital gain tax), or in the future the gain is just the increase in value since it was inherited.

Don’t lose sight of the fact that 12 states and DC impose their own estate taxes with varying exemptions and rates ranging from 8% to 20%, and 6 states have inheritance taxes with rates of about 1% to 18%. You may not be out of the woods quite yet.

SALT:

The infamous and often operatic debate over the State and Local Tax deduction resulted in an increase in that deduction from $10,000 per tax return to $40,000, reverting back to 10k in 2030. Perhaps less publicized is the PTET — Pass-Through Entity Tax, which allows pass-through entities like LLCs and partnerships to pay state income tax at the entity level, rather than passing that tax obligation through to individual owners. By doing so, this allows the entity to deduct the full amount of the tax as a business expense, effectively by-passing the SALT cap. The PTET is unchanged in the new tax law.

In conclusion:

The 2025 tax law brings a mix of permanent changes, updated incentives, and new planning opportunities that real estate investors will want to pay attention to. Whether it’s bonus depreciation, the QBI deduction, expanded Opportunity Zone benefits, or estate tax updates, these provisions could directly affect how you structure deals, manage your portfolio, and plan ahead. As always, it pays to run the numbers and work with trusted advisors—because good planning starts with good information.

Tools like RealData’s REIA software can help you project before- and after-tax cash flow with greater accuracy—so you can make better-informed decisions in a changing tax environment.

The information provided in this article is for educational and informational purposes only. It is not intended as, and should not be construed as, tax, legal, or investment advice. Every investor’s situation is unique, and the application of tax law can vary based on individual facts and circumstances. You should consult a qualified tax advisor, attorney, or financial professional before making decisions based on the information presented here.

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

Mastering Real Estate Investing

Learn how real estate developers and rehabbers evaluate potential projects. Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches in-depth video courses, where you’ll develop the skills and confidence to evaluate investment property opportunities for maximum profit.