We hear all the time that real estate investors who use our RealData investment analysis software are tuned in to any changes in the interest-rate environment.

Well… the Fed finally blinked. After two years of hikes that drove borrowing costs through the roof, the central bank cut its policy rate to 4.00%–4.25% in September. Good news, right?

Sort of. Mortgage rates are still in the mid-6s, the 30-year Treasury is bouncing around the high 4s, and credit spreads haven’t magically disappeared. In other words: Lower Fed rates don’t automatically translate into cheap financing or sky-high property values.

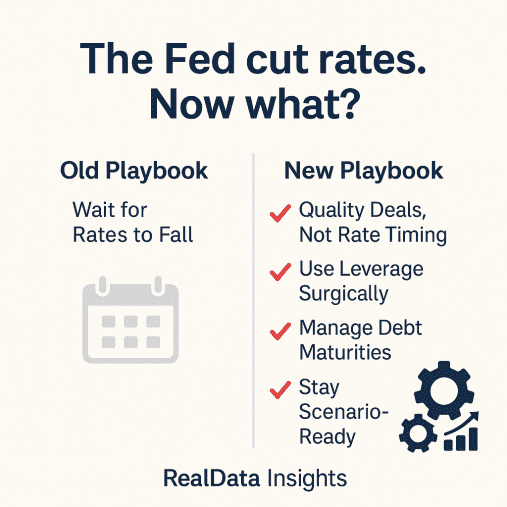

This is a market where perhaps “wait for rates to fall and then buy” doesn’t cut it anymore. The smart money is shifting from timing to structuring. Let’s break down what’s happening—and how real estate investors might choose to play it.

⸻

Rates: The Story Behind the Headlines

•Fed funds cut: ✔️ Yes, the FOMC moved to 4.00%–4.25%.

•Mortgages: 📉 The average 30-year fixed is still around 6.3%–6.5%—better than last year, but far from cheap.

•Treasurys: 📊 The 30-year yield has been hovering just under 5%. That keeps pressure on long-term borrowing costs.

•The Fed’s own forecast: 📰 They see unemployment ticking up to ~4.5% and growth staying modest in 2025.

Bottom line: Rates are easing a bit, but don’t expect a floodgate moment.

⸻

Cap Rates: What the Data Really Says

•CBRE’s midyear survey shows cap rates dipped about 9 basis points in the first half of 2025. Not dramatic, but a sign the market may have peaked on yields.

•Looking further out, CBRE projects cap rates will compress a little further by year-end compared to their 2024 highs:

•Industrial: −30 bps

•Retail: −24 bps

• Multifamily: −17 bps

•Office: −7 bps

That’s directionally positive, but here’s the catch: those forecasts assume borrowing costs keep sliding. If Treasurys or spreads flare back up, that compression can evaporate.

⸻

How Investors Are Tweaking Their Playbook

1) Stop Waiting for Perfect

For a while, “sit on cash until rates crash” was the default. But mild compression is already happening, and competition is heating back up. The better move now? Focus on deal quality and run your numbers with conservative exit assumptions.

2) Leverage—Handle With Care

If your debt costs more than your property earns, that’s negative leverage—and it’s still a risk. Again, focus on deal quality.

3) Sectors: Don’t Paint With a Broad Brush

•Industrial: Still the darling, but tenant quality matters more than ever.

•Multifamily: Stronger in high-barrier, unaffordable-for-buyers markets.

•Retail: Grocery-anchored and necessity-based centers look steady.

•Office: A contrarian play if you’ve got conviction—and patience.

4) Mind Your Debt Maturities

How and when you finance or refinance can be just as important as the property itself.

•Short-term gives flexibility but adds risk.

•Long-term fixed locks in stability.

•A laddered approach (staggering maturities) spreads out your exposure.

And don’t forget: Seller financing seems to be making a comeback. If a seller has a low-basis property, they may prefer installment payments over a giant tax bill—while you get cheaper debt than the bank would offer. Win-win, if structured right.

⸻

Scenarios to Keep in Mind

Think ranges, not certainties:

•Soft landing: Inflation cools, rates slowly drift down, property values grind higher.

•Sticky inflation: Long rates stay stubborn, spreads stay wide—cash flow is king.

•Recession: Forced sales hit the market—liquidity becomes your best friend.

⸻

The Real Takeaway

This isn’t 2020, and it’s not 2008 either. Rates are lower, but not low. Cap rates are compressing, but not collapsing.

That means the edge goes to investors who:

✔️ Buy quality over “cheap”

✔️ Manage leverage with discipline

✔️ Do their homework and run the numbers

✔️ Stay ready for surprises

The best way to identify quality opportunities? Run the numbers with a clear eye. And the best way to do that? Use world-class underwriting software.

⸻

Disclaimer: The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. This article is provided for educational purposes only and should not be construed as providing financial, investment, or legal advice. All economic data and forecasts are current as of October 2025 and are subject to change without notice. Real estate investing involves risk, including the potential loss of principal. Readers should conduct their own analysis and consult qualified professional advisors before making investment decisions.

⸻

Sources

•Federal Reserve FOMC Statement – Sept. 17, 2025

•Freddie Mac PMMS – Mortgage Rates

•U.S. Treasury Yield Curve Data

•CBRE U.S. Cap Rate Survey H1 2025

•CBRE Real Estate Market Outlook 2025 – Capital Markets

•CBRE Midyear Market Outlook 2025

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

Mastering Real Estate Investing

Learn how real estate developers and rehabbers evaluate potential projects. Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches in-depth video courses, where you’ll develop the skills and confidence to evaluate investment property opportunities for maximum profit.