Most real estate investors learn about capitalization rate (cap rate) early on—and for good reason. It’s a useful, at-a-glance measure of a property’s income in relation to its market value.

But cap rate has its limitations: it reflects only a single year of net operating income (NOI), ignores financing, and says little about long-term performance. It looks at a property at a point in time, not over the long term.

If you’re serious about evaluating income-producing real estate—especially in a competitive or uncertain market—you need to go deeper. In this article, I’ll walk you through five advanced metrics that provide a more comprehensive and strategic view of a commercial investment’s potential. Ready for that deeper dive?

1. Yield on Cost: Measuring the Return on Your Total Investment

Yield on Cost (sometimes called return on cost) is especially useful in development and value-add scenarios. It tells you what your expected return will be based on the cost to acquire, develop, or improve a property, rather than basing it on its market value.

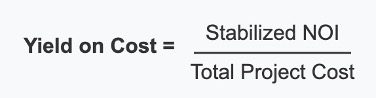

Formula:

To repeat: Cap rate measures income in relation to the value of a property. Yield on cost measures income in relation to the total cost of the property.

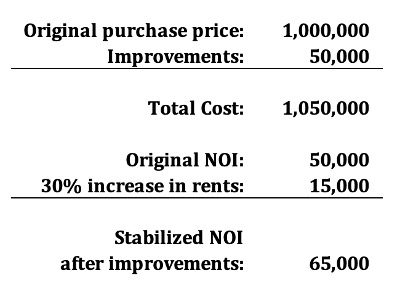

For example, you decide you’re going to buy a property today for $1 million because the NOI is $50,000 and the market cap rate of 5% (i.e., 50,000 divided by 5% cap = $1 million value). Your plan is to upgrade the property and raise the rents.

You’ll spend $50,000 on improvements so you can bump up rents by 30%. Let’s see how that looks:

Now you have a new total cost for the property of $1,050,000 – the purchase price plus the improvements — and a stabilized NOI that’s 30% higher than before, or $65,000. Let’s use the Yield on Cost formula, which basically looks a lot like the cap rate formula:

YOC = stabilized NOI / total cost

YOC = 65,000 / 1,050,000 = 6.19%

You notice that the yield on cost is higher than the cap rate—which leads us to another metric that often lives below the radar.

2. Development Spread: Quantifying Value Creation

The development spread is the difference between your yield on cost and the market cap rate. It reflects the premium you’ve generated by developing or repositioning the property.

Formula:

Development Spread = Yield on Cost minus Market Cap Rate

Continuing our example:

- Yield on Cost: 6.19%

- Market Cap Rate: 5.00%

- Development Spread = 1.19%

Now for a question that only you can answer: Is that spread worth the risk of undertaking this project?

One way that might help you decide is to ask: What do you think the property is going to be worth after you make these improvements? For that you cycle back to the standard cap rate formula, because that deals with value as function of income. You’ll use the market cap of 5% with your new stabilized NOI.

- Value = NOI / cap rate

- Value = 65,000 / .05

- Value = 1,300,000

Its value now, after these improvements, is $1,300,000, which is $250,000 more than your total cost.

- New value (1,300,000) minus total cost (1,000,000 + 50,000) = $250,000 increase

3. Debt Service Coverage Ratio (DSCR): Stress-Testing Your Net Operating Income

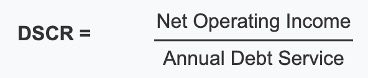

DSCR (aka DCR) measures how comfortably your property’s net income can cover its debt payments. Lenders use it to assess loan viability, but you should use it too—to understand your downside protection.

Formula:

A DSCR of 1.0 means you expect to have just enough net operating income to pay your debt service—not a dollar to spare. No allowance for a missed rent payment, a property tax increase, or even a faucet washer.

No lender I’ve ever encountered would consider giving a mortgage on an income property whose net revenue wouldn’t comfortably cover the debt payments. Most lenders want to see 1.20 to 1.30, perhaps even higher with riskier property types.

Regardless of your lender’s requirements, if your deal projects a tight DSCR, any unexpected hit to your NOI could leave you reaching beyond the property and into your own pocket to cover the mortgage payment. Not a situation you want to be in.

4. Equity Multiple: Total Return Over Time

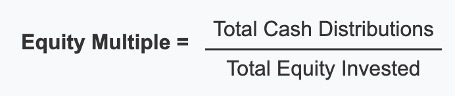

While IRR (Internal Rate of Return) gets a lot of attention for accounting for time value of money, equity multiple can be a simpler, intuitive way to evaluate an investment’s total return.

Formula:

If you invest $500,000 and receive $1,250,000 over the life of the deal—including your annual cash flows plus sales proceeds when you dispose of the property—your equity multiple is 2.5. In other words, over the life of your ownership, you pull out 2.5 times as much cash as you put in.

We’re going to save a discussion of internal rate of return for another article because it will deserve some extra space, but unlike IRR, equity multiple doesn’t consider when you receive your returns but only how much. Although there is no time-value-of money component here, many investors choose to use this along with IRR to compare potential outcomes among investment options.

This metric can provide a helpful perspective, especially if you have a time horizon in mind. Say, for example, that your goal is to cash out with the funds needed to retire in 30 years, or to pay for a child’s education in 15. Total cash received may mean more to you than the specific timing, or a rate-of-return threshold. Seeing the total expected return over the life of an investment can provide a more intuitive sense of the success of an investment.

5. Exit Cap Rate Sensitivity: Understanding Terminal Value

When projecting a future sale price, you need to make an assumption about an exit cap rate. You’ll use that cap rate, along with your projected NOI, to estimate an important component of your overall investment return: The expected price when you decide it’s time to sell. But a small change in that exit cap rate can have a significant effect on your projected returns. Sensitivity analysis helps you understand how exposed your deal is to market fluctuations.

Example:

If you expect to sell in Year 5 with a $700,000 NOI:

- At a 6.0% cap, value = $11.67M

- At a 6.5% cap, value = $10.77M

- At a 7.0% cap, value = $10.00M

That’s a $1.67M swing just from a 1% shift.

A smart investor will start by thinking about their going-in cap rate, i.e. the rate at which they purchased the property. Do you think the market for this property will get stronger over time, resulting in so-called rate compression (i.e., lower rate, higher valuations)? Or do you fear that the market will soften by the time you want to sell, resulting in higher cap rates and lower valuations relative to NOI?

The best path is probably to test multiple exit scenarios, multiple exit cap rates, to estimate a range of possible outcomes, and then to decide if you can be satisfied within that range.

Summing Up

Cap rate is and always has been a useful metric—but it’s just the starting point. For a comprehensive analysis, you need to understand:

- How much value you’re creating (Yield on Cost, Development Spread)

- Whether your income can support debt (DSCR)

- Your total return potential (Equity Multiple)

- Your sensitivity to market timing (Exit Cap Rate Assumptions)

- And of course, your overall rate of return over a specific time frame, and how that compare to other potential uses of your capital. For that, I go into some depth when I discuss Internal Rate of Return in a follow-up article.

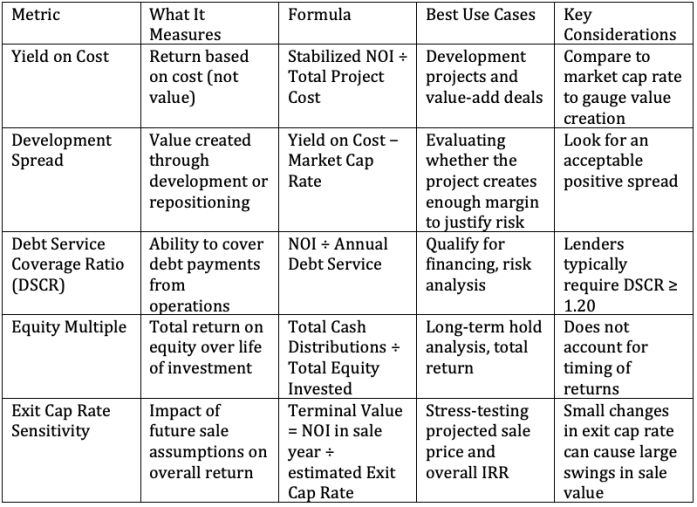

Advanced Metrics Comparison Chart

At RealData, our software products help you calculate as many as 23 metrics, so you can make better, data-driven decisions. If you’re serious about evaluating income property the right way, check out our Real Estate Investment Analysis software—built for both experienced professionals and beginning investors ready to move up.

And to learn more about all these metrics and how to underwrite different property types, see our online video courses at learn.realdata.com/courses.

Mastering Real Estate Investing

Learn how real estate developers and rehabbers evaluate potential projects. Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches in-depth video courses, where you’ll develop the skills and confidence to evaluate investment property opportunities for maximum profit.