Applies to: REIA Pro v17 and earlier – also REIA Express versions prior to Oct. 2018

This is a brief explanation of how to enter data on the various basic income worksheets of REIA Professional Edition. One of these basic income worksheets will appear, depending on the property type: Residential Income, Self Storage Income, Quick Commercial Income, or Continuing Care Income.

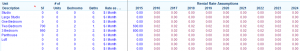

In the case of Residential Income, after you enter the total rentable square feet in cell C6, the rest of your entries will be in rows 11 through 35. Each of these rows represents a group of units with the same square footage and rent.

It’s especially important to enter the number of units in this group in column D. Otherwise, the program will assume this group has no units, and hence generates no income.

In column G, specify how you will enter the rent, as $ / Month, $ / SF / Month, $ / SF / Year or $ / Year. Then enter the average rent per unit for the first year in column I.

Starting in column J, enter the projected average rent for later years. If your entry is greater than 1, it is treated as an actual dollar amount. Otherwise it is taken as a percentage increase over the previous year. For example, 0.02 would indicate a 2% increase over the previous year.

When you are done, the left part of the data entry area will look something like this:

If you scroll down, you will see a table starting in row 41 showing the total income for each group of units:

The other basic income worksheets (Self Storage Income, Quick Commercial Income and Continuing Care Income) are similar, except that they omit the columns for number of bedrooms and bathrooms. Thus, you specify the unit of measure ($ / Month, $ / SF / Month, $ / SF / Year or $ / Year) in column E instead of G, and the average rent per unit for the first year is in column G instead of I.

See the User Guide for more information.