This article covers reimbursable expenses for Commercial tenants in REIA Pro. The screen captures are taken from version 17 but should apply to other versions.

REIA Professional allows the user to configure tenants in a property who will pay some or all of the property expenses. Note that this option is not available in the Express Edition, and, within Professional, applies only to tenant income which is configured on the Commercial Income worksheet. One cannot pass through expenses from tenants who appear on the Basic Income or other property-specific income worksheets.

First you must enter your tenants on the Commercial Income worksheet as well as property expenses on Annual Property Operating Data (APOD) worksheet.

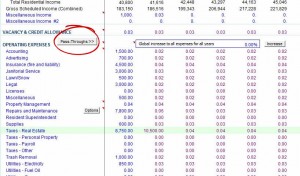

Now go to the APOD worksheet.

Scroll out to the right to Column X or use the “Pass-Throughs >>” button as shown in the image above.

Select the checkboxes in column X for those expenses which you wish to pass on to your tenants. This just indicates that you will be passing the expenses through to one or more tenants. If you wish to have a global base amount for expense items, enter that dollar amount in column AA. The base amount means that you, the owner, will pay up to that amount, and any above the base will be paid by the tenants.

Now go to the Commercial Income worksheet.

The image above shows detail for the first tenant on the Commercial Income worksheet. Note that in cell C20 a percentage displays. This percentage is based on a simple formula which calculates the pro rata share for that tenant. The percentage is the tenant’s square footage divided by the overall commercial square footage that you entered in cell C3.

You may choose to change the percentage for a particular tenant or change the amount to zero.

Note the Pass-Through Expense Base in row 23. This allows you to indicate a base amount for this particular tenant and configure that base for each year. The yearly entry gives you the flexibility to change the amount of the pass-through over time. When entering base years, be careful to not double up on base amounts – you entries here are in addition to the overall base amount on the APOD worksheet.