This article covers how to enter data into the Residential Income worksheet in REIA Professional version 20.

To display the Residential Income worksheet, select a residential property type on the General worksheet at cell C12, such as Apartment Building, Multi-Family or Mixed Use.

The Residential Income worksheet is divided into two sections: a data-entry section starting on row 11 followed by the calculated values beginning in row 41.

Simple Entry: First Year Rent and Annual Increases #

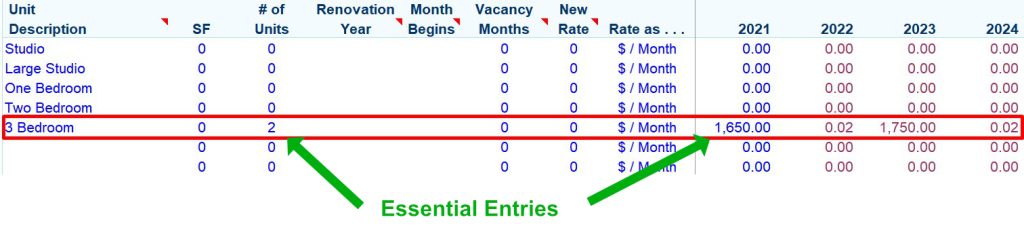

Minimal entries for a tenant include the following:

- A number of units in column D (must be 1 or greater)

- A first-year dollar amount rent in column K (displayed in blue)

- Optionally you can adjust the annual increases to be either a percentage or dollar amount.

- Optionally you can adjust the name of the unit. The name can be specific (“Apartment 3-G”) or generic (“3 Bedroom units”)

Your entry should look like this:

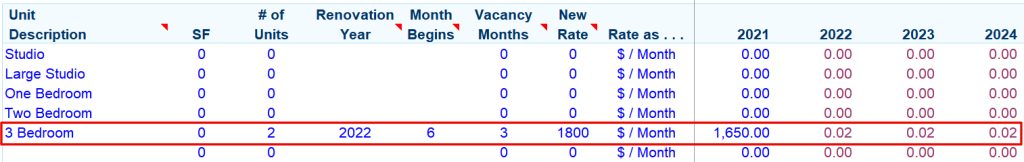

Advanced Entry: Allow for Renovation and/or Irregular Rate Change #

A few additional entries beyond the above can help you accurately calculate income where you are renovating one or more units and by necessity, there is a gap in income. For such a case, you will need to enter a year of renovation, the month that the renovation begins, the number of months that the new unit will be vacant and finally the new rate for the post-renovation period. Following the above example, if you are renovating in 2022 starting in June, the renovation will take 3 months and the new rate is $1800 per month, then your entries will look like this:

What this means: For the two units, the income begins in 2021 at $1650 per month. For January 2022 through the end of May, the rent is $1650 plus 2 percent. For June through August, there is no rental income. A new tenant moves in September 1st at $1800. Later, in January of 2023 and each year thereafter, you would simply have a 2 percent annual increase.

Let’s break down the rent in year 2022 for clarity:

- Months January through May are at a rate of $1650 + 2% per month. That is $1683 per month times 5 months times 2 units which is $16830.

- Months June through August there is no income.

- Months September through December the rent is $1800. $1800 times 4 months times 2 units is $14400.

- The total therefore is 16830 plus 14400 = $31230

Another Example – Mid Year Rate Change #

In your multifamily property, what if an apartment changes tenant mid-year with a corresponding rent increase? This almost the same situation as above except your Vacancy Months entry would be zero.

Just enter the lease turnover month as the “Month Begins,” leave Vacancy Months as zero and set the rate for the new tenant.