In the On Schedule model, you have a development loan for financing project costs. You draw from this interest-only loan as needed, and you typically apply a portion of unit sale proceeds toward principal repayment. This article shows you how to set up the development loan.

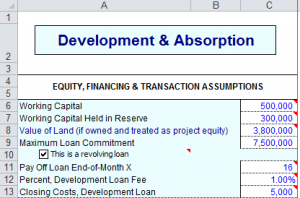

All of the entries for the development loan are on the Development & Absorption worksheet. Working Capital in cell C6 indicates how much funding will come from you and any partners. The rest will come from the development loan. Maximum Loan Commitment in cell C9 is the maximum amount you can draw from the loan.

Typically you should start out with rough estimates of Working Capital and Maximum Loan Commitment. Fill in the rest of Development & Absorption with your Site Costs and Development Projections. Then come back and tune Working Capital and Maximum Loan Commitment as needed to make the project work.

The interest rate is specified in row 118, because it can vary month by month. You would enter the rate for month 1 in cell D118. By default, this will propagate across the row, but you can enter adjusted rates in later months as needed. In row 107, you enter the percentage of sale proceeds to apply to loan repayment. Again, this can vary month by month.

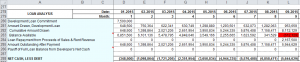

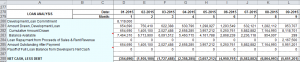

Once you have the rest of Development & Absorption filled in, it’s useful to look at the Loan Analysis starting in row 278. Specifically, row 283 is Balance Available which will have red shading if you are overdrawn.

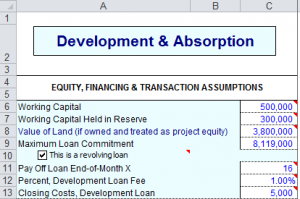

In this example, you are overdrawn by $612,129 in month 9. So you would go back to the top of Development & Absorption. By trial and error, you would adjust Working Capital and/or Maximum Loan Commitment until there is no more red shading in row 283. In this example, changing Maximum Loan Commitment to 8,119,000 does the trick.

The Loan Analysis now shows that you have $299 to spare in month 9.