One topic that often gets less attention than it deserves from real estate investors is resale. Some tend be dismissive, looking at resale as speculation, but many others simply find it difficult to focus seriously on the matter of selling a property they haven’t yet purchased.

It may take a little extra discipline to work a consideration of resale into your investment mindset, but it is just such discipline that often separates the successful investor from the sorry.

You care about the potential cash flow, the financing, the operating costs and the tax benefits. You had better care also about whether the property will be saleable after you buy it. Often one hears, “Yes, but I plan to keep it for 15 years, or until my toddlers graduate from med school, or until the Federal Reserve Board dances figure-eights on ice with the devil.”

That’s fine; may all your plans go without a hitch. But what if you need to sell this property next year? What if a better opportunity comes along, and you simply want to cash out? Recite this mantra whenever you consider purchasing an income property: If it’s not worth selling, then it’s not worth buying.

The world may not be perfect, but at least it’s flat – flat, as in “level playing field.” You can reasonably assume that if you would scrutinize a property’s income, operating expenses, financing, and various measures of return before you purchase, then tomorrow some equally astute investor will apply a similarly jaundiced eye to your numbers if you choose to sell.

It pays, therefore, to run tomorrow’s numbers today, and see just what this investment will look like to a future buyer.

So, what are the numbers that should concern you when you analyze the potential resale of an income-producing piece of real estate? The most obvious, and the most important, is the selling price.

If you have followed some of our other articles, you know that with most income properties, you can estimate the value at a point in time by applying a reasonable market capitalization rate to the net operating income. (If you have not read the articles, you will get probably get more out of this discussion if you go back and read them first. Look for Understanding Net Operating Income and Estimating the Value of a Real Estate Investment Using Cap Rate.)

In brief, you first determine the property’s Net Operating Income (NOI). Next you must estimate the capitalization rate (i.e., the rate of return) that the buyer would reasonably expect. The NOI is the amount of the return and the cap rate is the rate of return. Hence, if the market expects a 10% return and your property produces a NOI of $12,000, your estimate of its selling price would be $120,000. Another way of articulating the algebra involved is to say, “$12,000 represents 10% of what?”

A curious phenomenon exists in the real world. Buyers and sellers can look at the same information and see different meanings. This, I suspect, is the closest that commercial real estate will ever come to poetry. Not only might you have a different notion of “reasonable rate of return” as a seller, you might also change your perspective on NOI. It is common for a buyer to estimate value by capitalizing the current year’s NOI, and for a seller to capitalize next year’s expected NOI. The buyer typically takes the position, “I am buying the income stream that just happened, and the property’s value is based on that income stream. If the income goes up next year, that’s my business.” The seller, as a rule, will assert, “You didn’t own the building last year. You’re buying next year’s higher income stream. The value of what you’re buying should be based on that.”

You decide.

Once you develop your estimate of the resale price, the rest of the analysis of resale is fairly straightforward. You may want to calculate the estimated tax liability at the time of sale. Then, with that number in hand you can project the sales proceeds and the overall rate of return for the holding period.

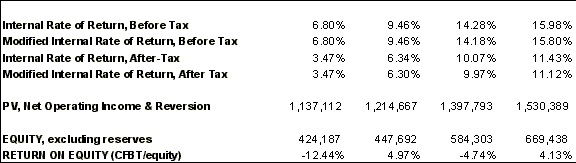

If you use RealData®’s Real Estate Investment Analysis software, you will have all of these calculations done for you. Equally important, the program will test a potential resale each year, allowing you to identify an optimum holding period. Let’s look at just the first four years of such an analysis.

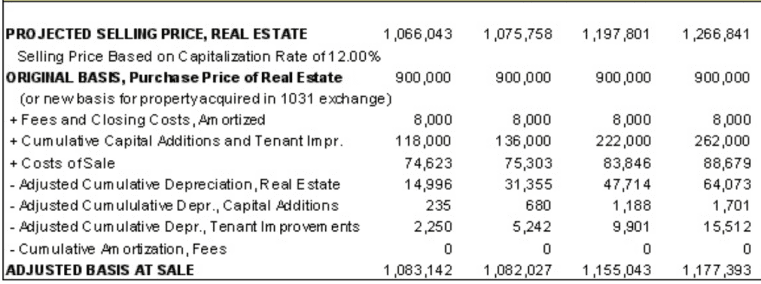

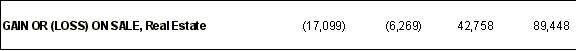

Our first task is to figure the gain. We do this by taking the selling price and subtracting from it the property’s Adjusted Basis.

What is the Adjusted Basis? It is the property’s original cost, plus capital improvements, plus closing costs and costs of sale, less accumulated depreciation. Essentially the Adjusted Basis is what you spent to purchase, improve and sell the property, less the amount you have already written off. If you sell the property for more than this amount, you have a taxable gain.

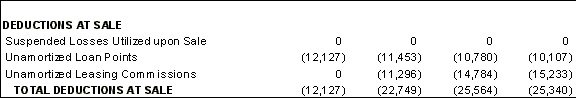

In calculating your tax liability at the time of sale, there are certain deductions that may come into play. For example, you may have had operating losses in prior years that you were not allowed to take because they exceeded your “passive loss allowance.” If you could not deduct them earlier, you can deduct them at the time of sale. You may also have had loan points and leasing commissions that you were amortizing (i.e., deducting over time). If you have an unamortized balance on these items, you can deduct it when you sell.

Now you have enough information to compute the tax liability due on sale.

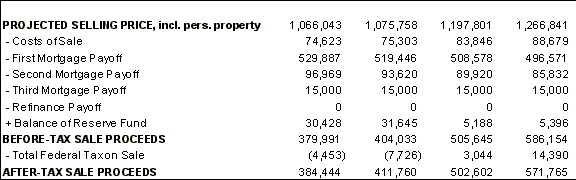

No doubt your greatest concern is the amount of cash you will realize from the sale. To determine that figure you must take the selling price, subtract the costs of sale (such as legal fees and sales commissions), subtract the outstanding balances of all mortgages and add back any unused funds left over in your reserve account. Now you have your Before-Tax Sale Proceeds. Subtract the Federal tax liability and you have the After-Tax Sale Proceeds.

The timing as well as the amount of your resale are important to your overall return. In this example, the software is computing that overall return for different holding periods and you can see that the timing can make a substantial difference.

Internal Rate of Return (IRR) is one of the most commonly used methods of measuring the quality of a real estate investment. Others include Present Value, Return on Equity, Cash-on-Cash Return and Debt Coverage Ratio. Some of these measures are fairly sophisticated, while others are quite simple. Check out “insights” for more about these topics.

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

Mastering Real Estate Investing

Learn how real estate developers and rehabbers evaluate potential projects. Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches in-depth video courses, where you’ll develop the skills and confidence to evaluate investment property opportunities for maximum profit.