People I know don’t generally view completing their tax returns as a recreational activity. The rules and forms strike many as opaque, and the process is often stressful. So it’s understandable that they may want to put the topic out of mind until next year.

However, there is at least one concept in the U.S. tax system that is both very simple and important, yet it is unfamiliar to many. That concept is the Marginal Tax Rate, and the short version goes like this:

Your marginal tax rate is the rate at which your next dollar of income will be taxed.

Let’s see just how that works and why it matters to you.

The Basics

Your tax liability is the amount of money you owe the government in taxes, and it’s calculated based on your taxable income. Taxable income starts with your gross income from sources such as

- wages

- self-employment income

- interest and dividends,

- rental income

- distributions from retirement accounts like IRAs and 401(k)s

- and a host of other potential sources

To get your taxable income, you then subtract deductions and exemptions allowed by the IRS—most commonly the standard deduction, which, since the 2018 tax law, is what about 90% of taxpayers elect, or by a list of itemized deductions if those add up to more than the standard.

It’s this taxable income that gets fed through the IRS sausage-making machine (aka tax tables or “tax brackets”) to come up with what you actually owe in taxes.

Tax Brackets

If the U.S. had a so-called “flat tax,” then each person would pay a fixed percentage of his or her income. For the sake of example (and putting all political agendas aside), let’s say the flat rate were 10%:

$10,000 income x 10% = $1,000 tax

$1,000,000 income x 10% = $100,000 tax

Simple enough. The person with the higher income would pay a proportionally higher tax.

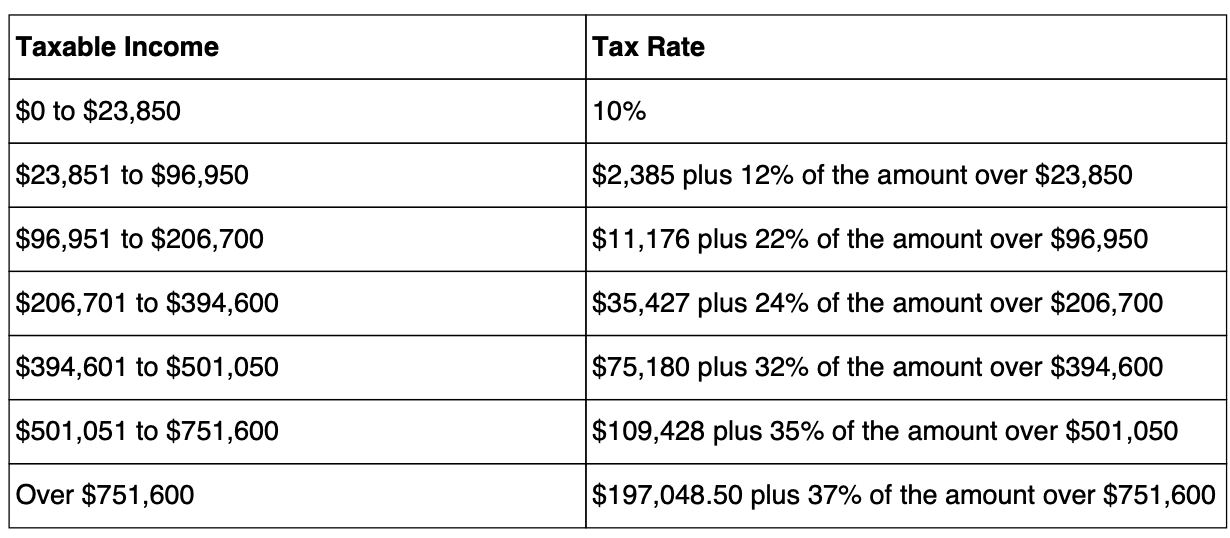

However, the U.S. has instead what we call a “progressive” tax system. It’s like a layer cake. The bottom layer is taxed at a certain rate; the next layer is taxed at a higher rate; the next at a still higher rate, and so on. We call these layers “tax brackets.” Here is what the brackets for a married couple filing jointly looked like in 2025:

The logic here is that the higher your income, the higher the rate at which that income will be taxed. The tax rate becomes progressively higher as income increases, hence the name.

What Is Marginal Tax Rate?

Your marginal tax rate is simply the rate at which your next dollar of income will be taxed. Let’s say that our married-filing-jointly couple, Jack and Jill, had income only from wages in 2025. After deductions, they had a joint taxable income of $206,700. They are at the top of what we would call the “22% tax bracket.”

Then Jill receives a one-time year-end bonus of $1,000, raising their total family income to $207,700. How much of that bonus will be lost to federal tax? Recall our table:

Every dollar earned starting with dollar # 206,701 (and continuing until they reach a total joint income of 394,600) is going to be taxed at 24%. So she will pay $240 of that bonus in federal tax.

$1,000 x 24% = $240

What Marginal Tax Rate Isn’t

If someone were to ask our couple what tax bracket they were in, they would say, correctly, “24%.” Many people assume, incorrectly, that this would mean they are paying 24% of their total income in taxes. But that is not the case. 24% is their marginal bracket. It’s the rate they’ll pay on the next dollar of taxable income, but it’s not the rate they’re paying on every dollar of income.

This couple is paying 10% of their first $23,850 of income, 12% of the next $73,100, 22% of the next $109,750, and 24% of the last $1,000.

In short, because the tax rates are applied progressively, at increasing rates on different layers of income — they are actually paying an effective rate that is just 17.11%, not the “We’re in the 24% tax bracket” rate.

Why Does It Matter to You?

Now that you understand how it works, you ask the obvious existential questions: So what? Why do I care?

Knowing your marginal tax rate is essential to anticipating the tax consequences of new income or new deductions. Consider some examples:

Our couple knows that their effective tax rate is currently around 17%, but their marginal rate is 24%. What if they decide to acquire a profitable new investment property? They need to recognize that the additional income, which is layered on top of their employment income, is going to be taxed at their marginal rate of 24%.

That information may factor into their decision as to whether the income from that property, after taxes, is attractive enough to justify the cost of purchase and the effort of managing.

What if they were thinking about making a $1,000 donation to charity at the end of 2025, or possibly waiting until next year to do so? If Jill’s bonus is indeed a one-time event, the couple might save more on their joint taxes if she makes that donation this year, while she is in the 24% bracket; but she would save less if she waits until next year when she expects to drop back under the 24% marginal rate and into the 22% bracket.

Perhaps in 2026, this couple encounters a fantastic real estate opportunity where they make a quick $300,000 profit on a fix-and-flip. Short-term gains are treated as ordinary income, so add this profit to the $206,700 taxable income they had expected from their jobs and you can see that they will catapult across two tax brackets.

At $506,700 total taxable income next year and assuming the tax tables remain the same, we can see that much of their profit — almost $188k of it— is going to be taxed in the next bracket, which is 32%, and the final $5,200 will creep into the 35% bracket.

Not to say that they shouldn’t be delighted by their windfall, but they should go into it with their eyes open, recognizing the higher rates at which much of that profit will be taxed.

One word of caution to so-called high-income investors (and that could mean folks who don’t even think of themselves as “high income” relative to the current cost of living): There are a variety of potential gotchas lurking for you in the ever-changing tax code. Certain deductions or exemptions may phase out, and the Net Investment Income Tax or Alternative Minimum Tax may kick in. Don’t try parsing this at home; consult a professional tax advisor.

For most people, however, awareness of their marginal tax rate and where they fall in the tax-bracket chart can be a help in understanding the consequences of changes in income and making informed tax-planning decisions.

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

Mastering Real Estate Investing

Learn how real estate developers and rehabbers evaluate potential projects. Real estate expert Frank Gallinelli — Ivy-League professor, best-selling author, and founder of RealData Software — teaches in-depth video courses, where you’ll develop the skills and confidence to evaluate investment property opportunities for maximum profit.