Internal Rate of Return (IRR) is the metric of choice for many, if not most, real estate investors. But there are a few issues with IRR that can cause you some vexation: If you expect a negative cash flow at some point in the future, then the IRR computation may simply fail to come up with a unique result; and with your positive cash flows, IRR may be a bit too optimistic about the rate at which you can reinvest them.

For these reasons, a variation on IRR, called Modified Internal Rate of Return (MIRR), can be a useful tool. Let’s see how it works, and see how it gives you the opportunity to deal with IRR’s shortcomings.

Category: Education

Internal Rate of Return (IRR) is arguably the most widely used metric in commercial real estate, and for good reason. It’s often called the gold standard for evaluating long-term investment performance. In this post, I’ll unpack what IRR really means, how to calculate it, where it excels, and where it doesn’t.

Most real estate investors learn about capitalization rate (cap rate) early on—and for good reason. It’s a useful, at-a-glance measure of a property’s income in relation to its market value.

But cap rate has its limitations: it reflects only a single year of net operating income (NOI), ignores financing, and says little about long-term performance. It looks at a property at a point in time, not over the long term.

If you’re serious about evaluating income-producing real estate—especially in a competitive or uncertain market—you need to go deeper. In this article, I’ll walk you through five advanced metrics that provide a more comprehensive and strategic view of a commercial investment’s potential. Ready for that deeper dive?

You’ve been watching the markets lately. How could you avoid it? You know the story: wild stock swings; headlines driving fear; nonstop chatter about tariffs, recession, interest rates, and global trade. It’s a jungle out there.

But amid all the noise, one thing hasn’t changed—and likely never will: real estate remains one of the smartest, most stable paths to building long-term wealth.

There is at least one concept in the U.S. tax system that is both very simple and really important, and yet I find that it is unfamiliar to many. And that concept is the marginal tax rate. What is it and why might it be important to you?

Internal Rate of Return (IRR) is a core metric for evaluating the profitability of income property investments. It is perhaps the one metric that accounts for the interplay between the magnitude and the timing of future cash flows.

From my experience, investors agree that a high rate of return is better than a low rate, but some are less clear about exactly what IRR is and how it’s calculated. So let’s start with some basics—and then dig deeper into levered and unlevered IRR.

I’ve just re-launched an updated version of my e-book, “10 Commandments for Real Estate Investors,” and you now can get it free on Amazon Kindle & Apple Books!

Real estate investing can be an excellent way to build wealth or to provide a cushion for your retirement; but it can also be a snare for those who lack preparation, planning, and realistic expectations.

In this brief series of essays, I guide you through some investment principles you can live by.

If you’re going to be serious about real estate investing, it’s imperative that you understand the numbers behind your deals.

That’s why I’ve always stressed my mantra, “First do the math, then do the deal.” I’m glad to help you simplify that task with my books, my online video courses, and my Excel-based software.

But maybe you’d like to just put a toe in the water first.

Leverage is a fundamental tool in real estate investing, allowing investors to acquire properties while using their own cash for just a fraction of the total cost. Borrowing money to invest in income-producing properties can amplify your returns, allowing you to scale faster than relying solely on your own capital. However, excessive leverage can prove to be a double-edged sword—when the market is in your favor, it opens the door to greater opportunity. But if the market turns against you, it can lift the lid on Pandora’s box. In this article, I’ll explore the benefits and some of hidden dangers of high leverage, how it can impact long-term investment success, and ways to strike the right balance.

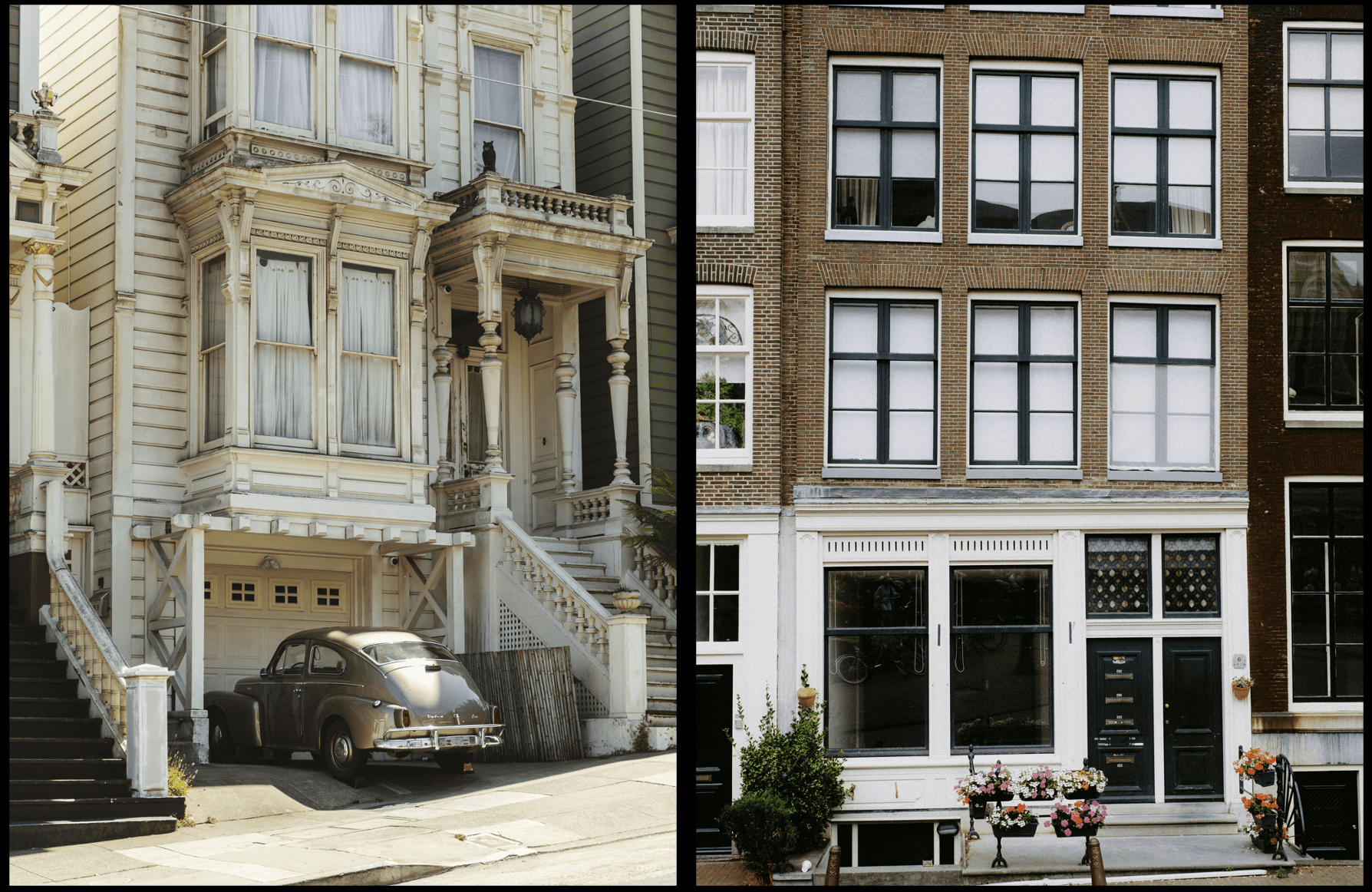

When you’re getting into real estate investing, especially if you’re starting out, there’s one big question to tackle early on: Should you go for value-add or turnkey properties? Both strategies have their pros and cons, their benefits and challenges, and this guide will help you figure out which is the better fit for your goals, budget, and experience.