The rise of home-sharing platforms like Airbnb has been a boon to property owners, especially owners of smaller income properties, but it has also prompted municipalities to introduce regulations on short-term rentals (STRs). Many places impose restrictions, such as requiring permits or licensing, limiting occupancy, and restricting the number of days permitted.

Author: Frank Gallinelli

We usually think of Return on Equity (ROE) as a straightforward investment measure. That’s understandable, because the traditional method of calculating ROE is pretty clear cut: Take your cash flow after taxes and divide it by your initial cash investment.

Inflation, interest rates, concerns about recession, pandemic-inspired work-style changes, taxes. There are enough wild cards in the deck to give any economic forecaster vertigo.

Not all real estate markets or all sectors are created equal, so to paraphrase an old TV auto ad, your mileage may vary. Nonetheless, we think it’s possible to make at least some reasonable and general forecasts about the near-term prospects for commercial real estate. Here is some of what we’re hearing, and thinking.

One topic that often gets less attention than it deserves from real estate investors, however, is resale. Some tend be dismissive, looking at resale as speculation, but many others simply find it difficult to focus seriously on the matter of selling a property they haven’t yet purchased.It may take a little extra discipline to work a consideration of resale into your investment mindset, but it is just such discipline that often separates the successful investor from the sorry.

Life is too complicated; we have too many choices, too many options, too many channels on cable TV. It’s not surprising that sometimes we crave simple answers to complex questions.

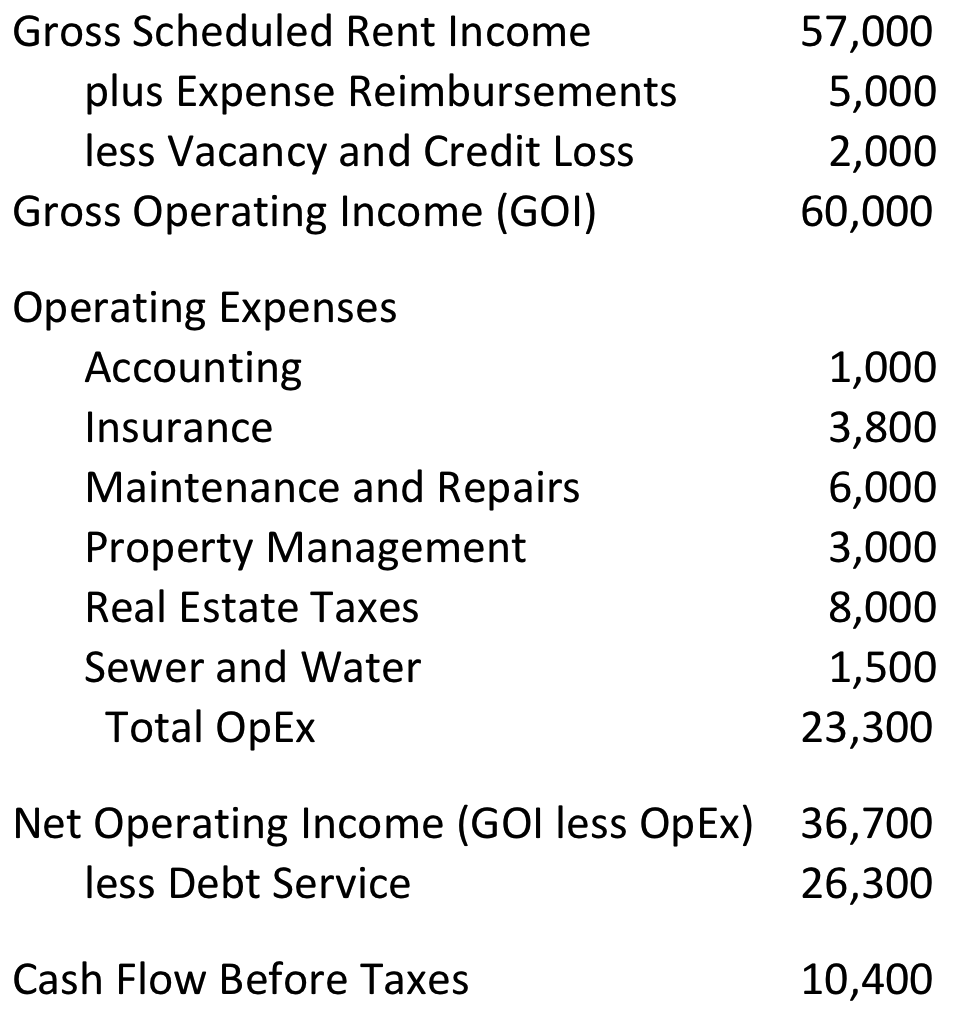

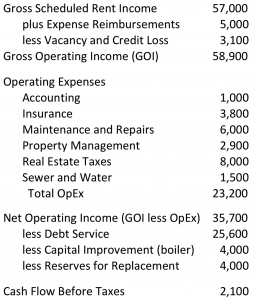

In the first part of our discussion, you looked at the simple math that underlies Cash-on-Cash Return. The short version goes like this: First you calculate your property’s first-year cash flow before taxes—essentially all the cash that comes in from operating the property minus all the cash that goes out. Then you divide that by your initial cash investment, and that percentage is your Cash-on-Cash Return. Nothing could be simpler.

Not all partnerships include a preferred return but, in those that do, its purpose is to counterbalance the risk associated with investing capital in the deal. Typically, the investor is promised that he or she will get first crack at the partnership’s profit and receive at least a X% return, to the extent that the partnership generates enough cash to pay it. In most partnership structures, the cash flow is allocated first to return the invested capital to all partners. The preferred return is paid next, before the General Partner or Managing Member receives any profit.

A while back, I posted a two-part series called “The Cash-on-Cash Conundrum.” In the first installment I explained the calculation and underlying logic of CoC, and in the second I discussed some of the pitfalls of overreliance on this particular measure.

It may sound like a nit-picking detail: Where and how do you account for “reserves for replacement” when you try to value – and evaluate – a potential income-property investment? Isn’t this something your accountant sorts out when it’s time to do your tax return? Not really, and how you choose to handle it may have a meaningful impact on your investment decision-making process.

Since we released the original version of our Real Estate Investment Analysis software in 1982, our focus has been on pro forma financial analysis of real estate investments and of development properties – projecting the numbers out over time to help users gain a sense of what kind of investment performance they might expect from a particular property or project. And for lo, these many years, our customers (and from time to time, we ourselves) have used the software to help make decisions as to whether or not to buy a property, and at what price and on what terms. Customers have used it to model how things might play out in the worst case, or in the best case, or somewhere in between. They have used it also to compare alternative investment opportunities.