A number of customers have asked if we’re updating our Real Estate Investment Analysis software because of the passage of the new tax law, effective in 2018. There’s still ambiguity about some provisions of the Tax Cuts and Jobs Act (which some might prefer to call the Law of Unintended Consequences), but we probably can parse it enough to make a few adjustments to the program. It may surprise you to know that, so far, we see the need for only a few simple changes in the software. But, of course, as technical corrections or other updates to the law occur, there could be others.

A number of customers have asked if we’re updating our Real Estate Investment Analysis software because of the passage of the new tax law, effective in 2018. There’s still ambiguity about some provisions of the Tax Cuts and Jobs Act (which some might prefer to call the Law of Unintended Consequences), but we probably can parse it enough to make a few adjustments to the program. It may surprise you to know that, so far, we see the need for only a few simple changes in the software. But, of course, as technical corrections or other updates to the law occur, there could be others.

The most important is that there are new tax brackets:

| Tax rate |

Single |

| 10% |

Up to $9,525 |

| 12% |

$9,526 to $38,700 |

| 22% |

$38,701 to $82,500 |

| 24% |

$82,501 to $157,500 |

| 32% |

$157,501 to $200,000 |

| 35% |

$200,001 to $500,000 |

| 37% |

$500,001 or more |

|

|

| Tax rate |

Married filing jointly |

| 10% |

Up to $19,050 |

| 12% |

$19,051 to $77,400 |

| 22% |

$77,401 to $165,000 |

| 24% |

$165,001 to $315,000 |

| 32% |

$315,001 to $400,000 |

| 35% |

$400,001 to $600,000 |

| 37% |

$600,001 or more |

On the assumptions page, you’ll see that we now use 24% as the default entry, but you can enter whatever is appropriate for you.

Other rates and thresholds – such as capital gain and Net Investment Income Tax – appear to be unchanged in the new law.

Under the depreciation choices, we’re removing what had been called “Optional 40-Year Straight Line for Residential or Non-Residential.” That also goes by the name, “Alternative Depreciation System,” and this year is changed to be 40 years for commercial, 30 for residential. We’ve encountered very few of our customers who use that, so we felt we could take this opportunity to simplify the data entry a bit. We’ve kept the choice of “Other Straight Line,” which allows you to accomplish the same result.

These changes are free of charge as part of a “new build” update. Download this latest build by logging into your customer account at https://realdata.com and going to the “Sign In” link at the top right of any page. If you are using the Windows version, you may also click the “check for updates” button on the Welcome sheet of your REIA program. We are happy to assist you via email, so look also to the upper right for a link to email us

Finally, a side note about an interesting tax item that is not in the program:

We have never dealt with income tax issues in our partnership analysis because partnerships typically pass income through to individuals, each of whom in turn pays tax personally on their portion of that income. However, a new provision in the 2018 law may potentially provide a 20% deduction of Qualified Business Income derived from such pass-through entities.

To figure who qualifies and how much might be deducted personally is not for the faint of heart, but if you expect to be the recipient of Qualified Business Income from a real estate partnership, this Cornell law school has a flow chart might be helpful.

Finally, a note on why we don’t try to go beyond a general estimate of tax consequences in our software. Particularly with the changes in the 2013 and 2018 bills, the tax system has taken an increasing holistic approach. Your other investments and income from other sources can impact how much your overall tax liability grows when you add a new investment to the mix. Pretty much everything is connected.

Analysis of a single property cannot realistically address an investor’s entire financial life. We try to gather from you a modest and reasonable amount of information, so we can give you back what we hope will be reasonable estimate of consequences.

As the year goes on, if there are any changes or technical corrections to the law that we feel should affect the program, we’ll let you know here on our blog.

— Frank Gallinelli

####

Your time and your investment capital are too valuable to risk on a do-it-yourself investment spreadsheet. For more than 30 years, RealData has provided the best and most reliable real estate investment software to help you make intelligent investment decisions and to create presentations you can confidently show to lenders, clients, and equity partners. Find out more at www.realdata.com.

Copyright 2018, Frank Gallinelli and RealData® Inc. All Rights Reserved

The information presented in this article represents the opinions of the author and does not necessarily reflect the opinions of RealData® Inc. The material contained in articles that appear on realdata.com is not intended to provide legal, tax or other professional advice or to substitute for proper professional advice and/or due diligence. We urge you to consult an attorney, CPA or other appropriate professional before taking any action in regard to matters discussed in any article or posting. The posting of any article and of any link back to the author and/or the author’s company does not constitute an endorsement or recommendation of the author’s products or services.

A number of customers have asked if we’re updating our

A number of customers have asked if we’re updating our

We’ve just released an updated version of our video tutorial,

We’ve just released an updated version of our video tutorial,

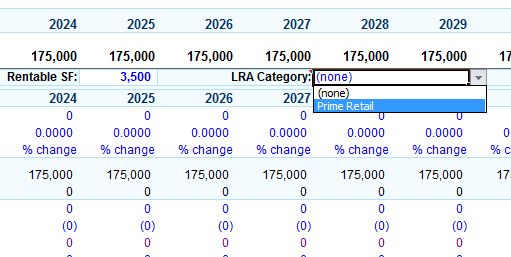

Globally adjust view +10% +25% etc. – Perhaps your desktop has one screen resolution and your laptop something totally different. And maybe neither of them looks good in the default view when you open the program. In the past you had to change the “zoom” setting for each worksheet individually, but we’ve added a function that allows you to apply a global view setting across all the sheets. So whether you want big type or small, the solution is a click away.

Globally adjust view +10% +25% etc. – Perhaps your desktop has one screen resolution and your laptop something totally different. And maybe neither of them looks good in the default view when you open the program. In the past you had to change the “zoom” setting for each worksheet individually, but we’ve added a function that allows you to apply a global view setting across all the sheets. So whether you want big type or small, the solution is a click away.